interest tax shield calculator

The formula for tax shields is very simple and it is calculated by first adding the different tax-deductible expenses and then. So for instance if you have 1000 in mortgage.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Value of Tax Deductible-Expense x Tax Rate.

. Tax_shield Interest Expense Tax_rate 20000 35 7000. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. What is the formula for tax shield.

Lets understand this with the help of an example of a convertible bond. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows.

Therefore the companys gross profit equals 14 million. Net present value calculator. Simpleaccounting rate of return ARR calculator.

Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. Interest Tax Shield Interest Expense Tax Rate. Interest Tax Shield Formula And Excel Calculator Relevance and Uses of Accrued Interest Formula.

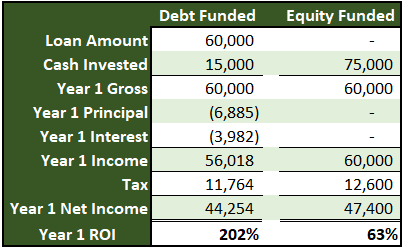

A tax shield refers to deductions taxpayers. Gross Profit 20 million 6 million. Without the tax shield Company Bs interest payment is just an expense that decreases a firms profitability and hits its cash flow.

The term tax multiplier refers to the multiple which is the measure of the change witnessed in the Gross Domestic Product GDP of an economy due to change in taxes introduced by its government. For individuals Tax rate is primarily used for interest expense and depreciation expense in the case of a company. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example.

Calculating the tax shield can be simplified by using this formula. DA is embedded within a companys cost of goods sold. Interest Expense 0 million.

It is possible to calculate the value of a tax shelter by multiplying the entire amount of taxable interest expenditure by the applicable tax rate. The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense. This small business tool is used to derive the interest tax using the average debt tax rate and cost of debt.

In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense. Else this figure would be less by 2400 800030 tax rate as only depreciation would. Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues.

Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million. This is equivalent to the 800000 interest expense multiplied by 35. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows before taxation work out to USD 8 million.

Easily Project and Verify IRS and State Interest Federal Penalty Calculations. So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

On the other hand Company Bs taxable income becomes 31m after deducting the 4m in interest expense. 02022022 By Carol Daniel Legal advice. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

Interest Expense 20000. This step by step finance tool is used for calculating the interest tax shield. Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

After-tax benefit or cash inflow calculator. Interest Tax Shield is defined as follows. Interest Tax Shield Calculator.

The good news is if. Tax Rate 20. Tax rate 35.

How to calculate the tax shield. Future value of an annuity calculator. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution medical expenditure etc.

Depreciation tax shield calculator. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. It is an integral part of the discounted valuation analysis which calculates the present value of a firm by discounting future cash flows by the expected rate of return to its equity and debt holders.

Interest Tax Shield Calculator. Basically the company uses two main tax shield strategies. Net present value calculator.

And an interest expense of 10 million. In such a case one needs to add back the after-tax interest expense to the income. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company from taxes paid. It is neither received nor paid. The Interest Tax Shield is the same as the Depreciation Tax Shield in concept.

This income reduces the taxpayers taxable income for a given year or defers income taxes into future periods. In a similar way we save the cash flows and increases the value of a firm. For instance there are cases where mortgages may have an interest tax shield for buyers since the mortgage interest is deductible against income.

One of the main objectives of companies is to. If you like Interest Tax Shield Calculator please consider adding a link to this tool by copypaste the following code. This step by step finance tool is used for calculating the interest tax shield.

Interest Tax Shield Calculator. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rateFor instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation amortization and depreciation.

If a corporations tax rate is 210 percent and the company incurs 1 million in. Ad TaxInterest is the standard that helps you calculate the correct amounts. As such the shield is 8000000 x 10 x 35 280000.

And this net effect is the loss of the tax shield value but again of the original expense as income. A formula to calculate after-tax interest expense is interest expense 1 Tax. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the.

The Interest Tax Shield is the same as the Depreciation Tax Shield in concept. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. The tax rate for the company is 30.

Interest Tax Shield Formula And Excel Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shield Formula And Excel Calculator

Depreciation Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

How Tax Shields Work For Small Businesses In 2022

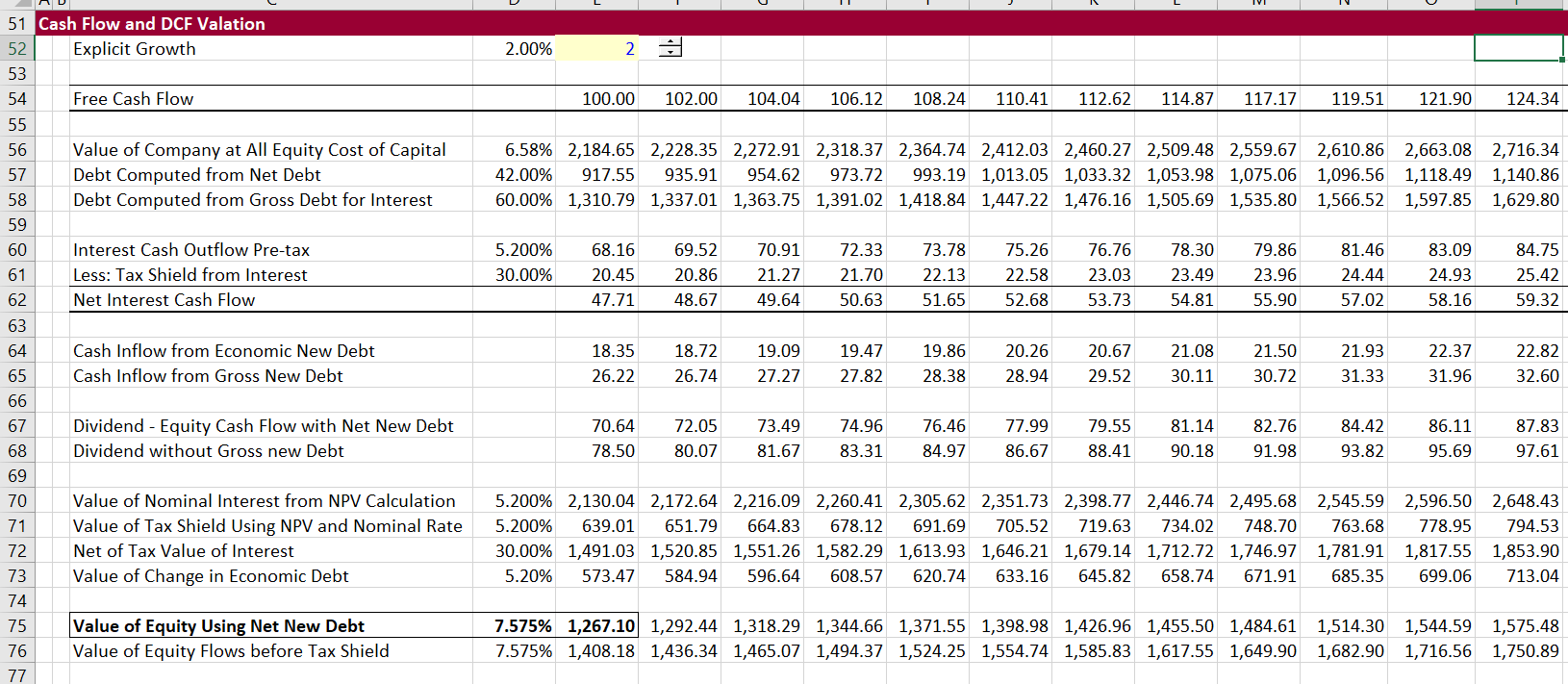

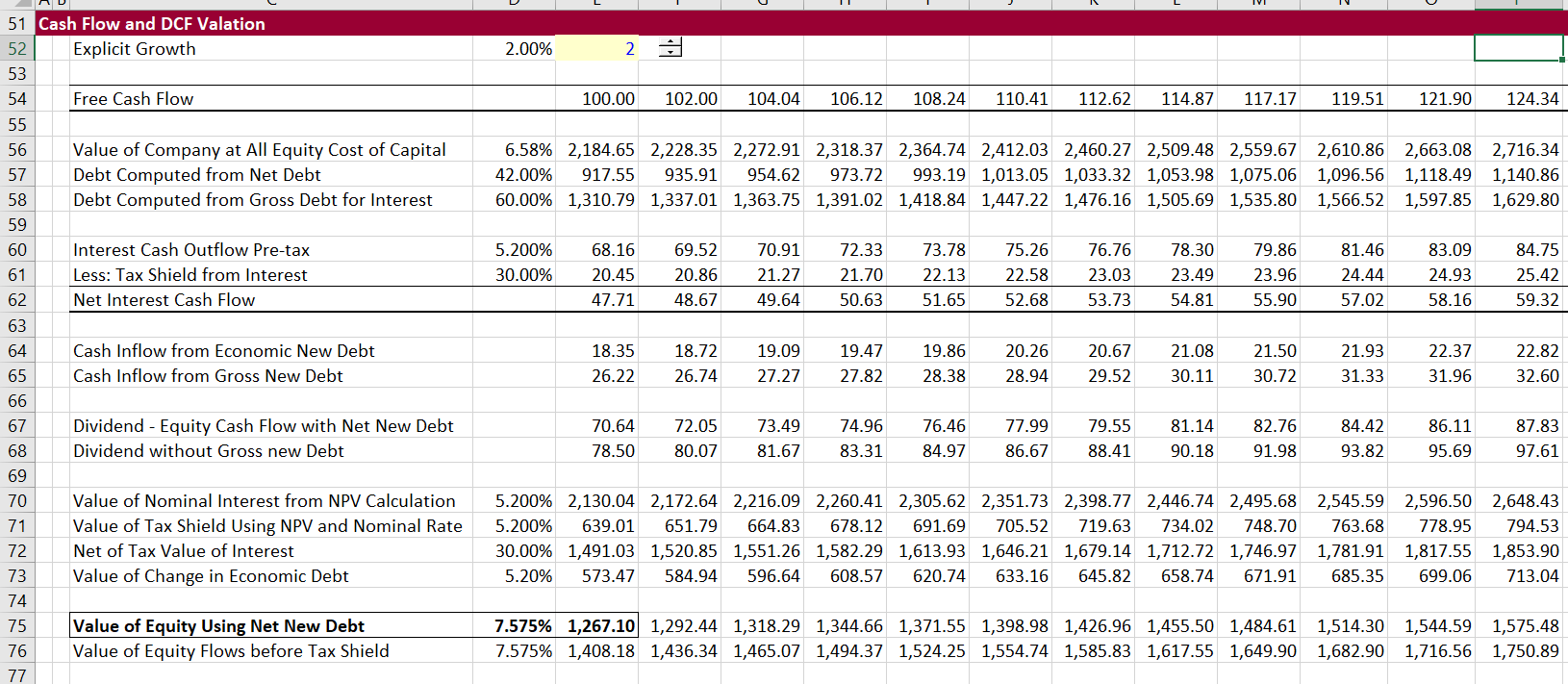

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples